|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Rate to Refinance Home: Expert Tips and AdviceRefinancing your home can lead to significant savings, but finding the best rate is crucial. Whether you're looking to lower monthly payments or refinance to get cash out, understanding the process is key. Understanding Refinancing RatesRefinancing involves taking out a new loan to pay off your existing mortgage. The primary goal is usually to secure a lower interest rate. However, it’s important to consider all the factors that might affect your rate. Factors Influencing Rates

Steps to Secure the Best RateSecuring the best refinancing rate requires preparation and research. Follow these steps to maximize your savings. Evaluate Your Financial HealthBefore you start, assess your credit score, debt-to-income ratio, and current home equity. These factors will influence the rates offered to you. Shop Around

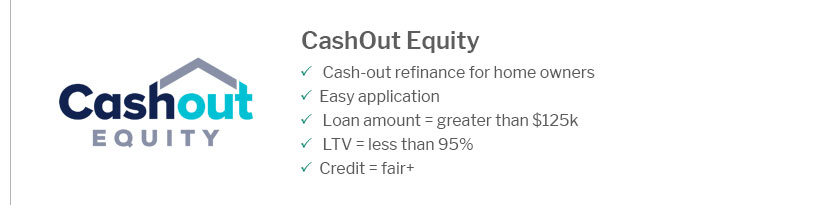

Common Refinancing OptionsUnderstanding different refinancing options can help you make an informed decision. Rate-and-Term RefinanceThis is the most common option, focusing on securing a lower interest rate or changing the loan term. Cash-Out RefinanceAllows you to access your home's equity in cash, which can be used for other expenses or investments. FAQ

Refinancing can be a smart financial move when done correctly. Understanding your options and the factors that affect rates will help you make the best decision for your situation. https://www.bankrate.com/mortgages/refinance-rates/

30 year fixed refinance. Points: 1.456. 8 year ... https://www.investopedia.com/mortgage/refinance/when-and-when-not-to-refinance-mortgage/

Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% ... https://www.reddit.com/r/Mortgages/comments/1fiavzr/what_refinance_rates_are_you_getting_right_now/

The best offer I've gotten so far is 5.875% for a 30-year conventional loan with no points, no closing costs (with $2400 in lender credit), and an escrow ...

|

|---|